Online Banking

Online Banking

Securely access your accounts and manage your money whenever you want. Access is free – all you need is a Fusion MemberCard and Personal Access Code (PAC).

What Can Online Banking Do For You?

- Check your account balances and view transaction history

- Pay bills including Business Taxes

- Manage your bill payees

- Send an INTERAC e-Transfer

- Manage your spending and trends

- Create a chequing or savings account

- View your statement

- Set up alerts notifying you of various account activities

- Stop cheques

- Transfer funds between multiple accounts including your US funds account and other Fusion members

- NEW* Debit Card Management. Lock or unlock your debit card easily.

What Do You Want To Learn Today?

- View your Aviso investment accounts directly in online and mobile app – no need to sign in separately.

- See your account balances, recent transactions and investment details in a single, secure view.

- Link multiple Aviso products, including Aviso Wealth, Qtrade Investor and Qtrade Guided Portfolios, using your Aviso Client ID.

- Easy Setup in Three Steps.

- Gain secure, convenient access to your investment information – right alongside your everyday banking.

- Linked Aviso accounts are view-only in digital banking. To make trades or manage investments, you’ll still sign in to Aviso directly.

- Disconnect linked accounts anytime through online or mobile app and re-link them whenever needed.

- Select "Wealth Management Accounts" in the main "Accounts" drop-down menu.

- Select "Link Account"

- Select the Aviso Product: Aviso Wealth, Qtrade Investor or Qtrade Guided Portfolios

- Enter the following information: Client ID, Last Name and Postal Code.

- Select "Continue"

- The product selected will be displayed at the top of the "Details" form.

- Birthdate will be pre-populated from the Fusion core banking system.

- In the “Client ID” field, there is a small icon that indicates a tooltip. The tooltip will display a pop-up showing members where they can find their Aviso client ID on their Aviso statement

- Click "Continue" if all details are correct or "Back" to make changes.

- A confirmation message will appear, indicating that the wealth management account is now linked.

A. Once signed in to digital banking, the account linking process only take a few minutes. After accounts are linked, they are immediately viewable in digital banking.

A. No, Aviso is only available for members with personal banking accounts.

A. Aviso is available on both online banking and the mobile app.

- Receive refunds and benefit payments faster and securely.

- Easy to sign up; minimal information required.

- Access to your money faster - no longer need to wait for the cheque to arrive in the mail and then get it processed.

- Available to both personal and small business members

- Available through all digital banking channels - online, iOS and Android apps

- To be eligible for this service, you must have a relationship with Fusion for at least 30 days. The account you wish to set up with direct deposit must be opened for at least 29 days.

- Log into digital banking

- Go to "Accounts"

- Under Cards, select "Manage debit cards"

- Choose card (if applicable)

- Lock/Unlock the desired lock feature for their respective debit card

A: Once you toggle the lock on or off, the change takes place immediately.

A: No, there are no notifications/alerts related to this service.

A: Yes, we recommend that you lock the card immediately to prevent unauthorized transactions until you find it or report it lost or stolen.

How To Log In For the First Time

Visit fusioncu.com and click 'Sign In' on the top right-hand corner.

-

Sign in using your current member/debit card and Personal Access Code (PAC)

-

Choose a unique username. Please note that once you’ve selected a username, it cannot be changed.

-

Choose a unique password using the following criteria:

-

Alphanumeric

-

Minimum 10 characters

-

Maximum 35 characters

-

1 uppercase letter

-

1 lowercase letter

-

1 number

-

1 symbol (this is not displayed on the password indicator but is allowed)

- For tips on how to create a strong password, click here.

-

-

Enter your mobile phone number and/or email address when prompted.

-

You may be asked to verify your date of birth. To complete the field, please enter your contact information in this format: mm-dd-yyyy.

-

You will receive a verification code on your mobile phone or email. Please be aware that it may take a few minutes for the code to show up in your email.

-

If you don’t receive your verification code, please check your junk mail folder. If still not received within 10 minutes, please resend the code. If a second verification code is requested, enter the second code you receive - if you have 2 verification codes the latest one you received is the one that must be entered. If the code is still not received, please contact us at 1-877-226-7957.

-

Enter that code on the pop-up screen when prompted.

-

If the contact information you enter does not match what we have on file, you will not be able to receive your verification code. Please contact us at 1-877-226-7957 to verify your contact info.

-

If everything is correct, click “Create user profile” to finish up.

Please use your new username and password to now enter the online banking and mobile app.

If your business has more than one signer, each signer will need to log in and create their own username and password.

Visit fusioncu.com and click "Sign In" on the top right-hand corner.

-

Sign in using your current member/debit card and Personal Access Code (PAC)

-

Choose a unique username. Please note that once you’ve selected a username, it cannot be changed.

-

Choose a unique password using the following criteria:

-

Alphanumeric

-

Minimum 10 characters

-

Maximum 35 characters

-

1 uppercase letter

-

1 lowercase letter

-

1 number

-

1 symbol (this is not displayed on the password indicator but is allowed)

-

-

Enter your PERSONAL mobile phone number and/or email address when prompted.

-

You may be asked to verify your date of birth. To complete the field, please enter your contact information in this format: mm-dd-yyyy.

-

You will receive a verification code on your mobile phone or email. Please be aware that it may take a few minutes for the code to show up in your email.

-

If you don’t receive your verification code, please check your junk mail folder. If still not received within 10 minutes, please resend the code. If a second verification code is requested, enter the second code you receive - if you have 2 verification codes the latest one you received is the one that must be entered. If the code is still not received, please contact us at 1-877-226-7957.

-

Enter that code on the pop-up screen when prompted.

-

If the contact information you enter does not match what we have on file, you will not be able to receive your verification code. Please contact us at 1-877-226-7957 to verify your contact info.

-

If everything is correct, click “Create user profile” to finish up.

Please use your new username and password to now enter the online banking and mobile app.

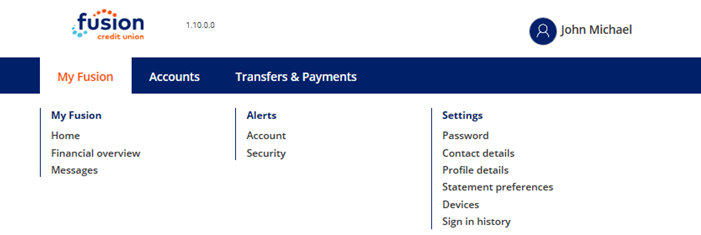

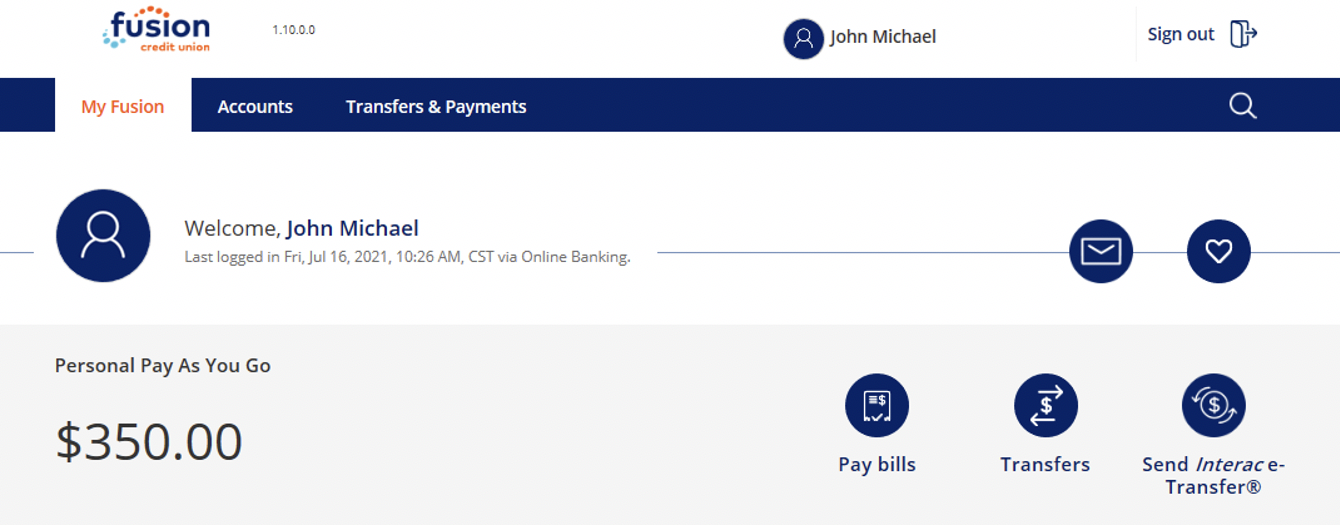

Explore Online Banking

With our easy to navigate menus, you can customize your digital banking experience. Let's start exploring!

Log into your Fusion account using your computer or phone.

Once logged in you can:

- select your own profile picture

- view the balance of your favorite account

- access shortcuts to pay bills and send transfers

- send a secure message to our eServices by clicking on the envelope

- view financial overview, favorite transactions and recent activity

Financial Overview and Messages

Obtain a Financial Overview of your accounts and view sent and received messages.

Alerts

Account Alerts - Be notified of withdrawals, balance alerts, insufficient funds or failed transactions on your account(s).

Security Alerts - Get alerts for password changes, attempt locks, successful logins and biometric access completions.

Settings

Password – allows you to change your password frequently for your own security

Contact Details – Update your address, phone and email

Profile or Background Picture – Personalize your experience by uploading your own profile and background picture

Statement Preferences – choose paper or electronic statement

Devices – view, lock or unlock devices used to access your digital banking

Sign-In History – View channels and dates used to log into your digital banking

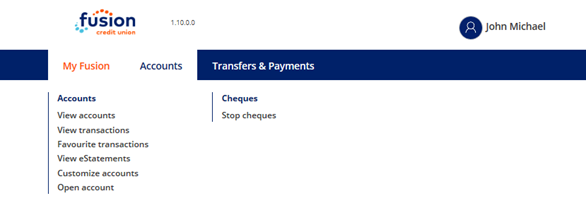

View accounts, transactions and eStatements – view all account details and transactions, including archived eStatements

Favorite transactions – create shortcuts for favorite transactions, name accounts and change the order of lists

Open a new account – open an individual new chequing, savings and/or investment accounts

Stop cheques – stop payments on cheques.

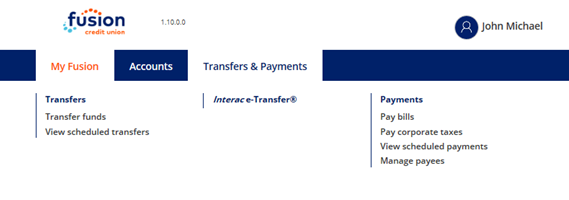

Transfers – transfer funds between your own accounts or to another Fusion member. Transfer funds to occur in real-time, schedule future payments and set up recurring transfers.

Interac eTransfers – send an eTransfer

Payments – pay bills to occur in real-time, schedule future bill payments or set up recurring bill payments. View scheduled payments and manage all of your payees and Interac e-Transfer recipients.

How To Keep Your Accounts Safe

Note: Fusion staff will never ask for your password and cannot see your current password.

What makes a good password?

1. Use a strong, unique password:

- Length matters: Aim for at least 12–16 characters.

- Mix it up: Combine uppercase and lowercase letters, numbers, and special characters.

- Avoid the obvious: Don’t use names, birthdays, or common words like “password” or “123456.2.

- Using the same password across multiple sites increases your risk. If one site is breached, all your accounts become vulnerable.

- You MUST use a different password for your online banking than other services (such as email, social media, or shopping sites)

- A passphrase is a type of password that uses a sequence of words or a full sentence instead of a single word or random characters. It’s designed to be both easier to remember and harder to crack than traditional passwords.

- Use 4–6 unrelated words (e.g., CoffeeTigerWindowJazzMoon).

- Add punctuation or numbers for extra strength.

- Avoid famous quotes or song lyrics, they’re easier to guess.

To update your Fusion CU account password with Online Banking (Browser, Desktop)

1. Sign in to online banking

2. Hover over My Fusion

3. Under Settings click on Password

4. Under Password details enter your current password and the new password. When done click Continue

5. You will receive a notification to your email that you have updated your password

To View Devices in Online Banking (Browser, Desktop)

1. Sign in to online banking

2. Hover over My Fusion

3. Under Settings click on Device Management

4. If you see any unauthorized devices, click the switch on the right-hand side of the list to lock the device. The status will change from Active to Locked.

To view Sign-In History in Online Banking (Browser, Desktop)

1. Sign in to online banking

2. Hover over My Fusion

3. Under Settings click on Sign-In History

4. You will see a list of your previous sign-ins with a time and date listed. If you see a time and date that you do not recognize, change your password and call Fusion eServices immediately.

Account Alert Types

• Withdrawal - When withdrawals over a set limit are made from your account

• Deposit – When deposits over a set limit are made to your account

• Balance – Account balance sent on the following frequency - daily, weekly, monthly and low (If your account drops below a set value an alert will be sent).

• Insufficient funds – When there are insufficient funds for scheduled transfers or bill payments

• Failed Transactions – Notifies of the following failed transaction types (Scheduled transfers and Scheduled bill payments).

Security Alert Types

• Successful login (Optional) - Notifies you for any successful login. This is optional but is recommended. Note: This notification can be delayed and is not instant, please keep this in mind and double check the alert details based on your own, known account activity.

• Password changed (Mandatory) - Alerts for any password changes on your account. This is mandatory via email but can be sent as an SMS or push notification.

• New biometric access (Mandatory) - Alerts for any new biometric access set up on your account. For example, when adding access with FaceID or fingerprint through the mobile application. This is mandatory via email but can be sent as a SMS or push notification.

• Password attempt lock (Mandatory) – If your account password has been entered wrong too many times you will receive a notification that your account has been locked. This is mandatory via email but can be sent as an SMS or push notification.

• Update contact details (Optional) – This will notify you on a successful change of your account contact details (phone number, email).

1. Sign in to online banking

2. Hover over My Fusion

3. Under Alerts click on Account or Security

4. You will see a list of the different alerts. You can then toggle them on or off for each of your preferred alerts and notification method.

Review and Remove Unnecessary Accounts from Your E-Agreement

Ensure that only essential accounts are included in your e-agreement for online banking. Removing accounts that are no longer needed can reduce exposure and enhance account security.

Maintain Accurate and Up-to-Date Contact Information

Regularly verify that your contact details are current, especially during branch visits. This includes ensuring that the information we have on file for all account holders is accurate and complete.

Conduct Periodic Reviews of Your Online Banking Profile

Routinely check your list of bill payees and Interac e-Transfer contacts to confirm their accuracy and relevance.

Remove Inactive or Unused Contacts and Payees

Delete any bill payees or Interac contacts that you no longer use to streamline your account and minimize potential security risks.

The following sections of account types should be secured with two-factor authentication (2FA) where possible. If any service that you use provides you with the option to set up 2FA with an application such as Microsoft Authenticator, Google Authenticator, Authy, etc. that is the recommended option as the codes provided by an authenticator application are harder to spoof.

While SMS two-factor authentication is not generally recommended, this is the only option supported by some services. In these cases, SMS is acceptable as it is better than no 2FA at all.

Email Accounts

NOTE: It is highly recommended to set up two-factor authentication (2FA) for the email account that you use with Online Banking. This will decrease the likelihood of an account takeover through email.

Email accounts provided by internet service providers (ISP) are not recommended for use with Fusion Online Banking. These email accounts are generally provided with a “best effort” service and do not have advanced security features such as two-factor authentication. Recommended email accounts for online banking use are Google/Gmail and Microsoft Outlook for personal banking or your business email address when using online banking with your business bank account.

• Google/Gmail (Turn on 2-Step Verification - Computer - Google Account Help)

• Microsoft Outlook (How to use two-step verification with your Microsoft account)

• Business Email – Contact your IT department or technology service provider

Mobile Device Accounts

Accounts that you use to sign in to mobile devices, services and Appstore’s can sync a great deal of personal information between devices/apps and could potentially sync passwords for other services to your account for use on other devices/browsers. Some examples of these account providers include

• Apple ID (Two-factor authentication for Apple Account - Apple Support)

• Google Account (Turn on 2-Step Verification - Computer - Google Account Help)

• Microsoft Account (How to use two-step verification with your Microsoft account - Microsoft Support)

• Samsung Account (How two-step verification protects your Samsung Account | Samsung CA)

Service Provider Accounts

Service providers such as internet service providers, utility providers (gas, hydro), tax payments, credit card accounts, etc. should be set up with 2FA when it is supported. This will protect your financial information on file with the provider as well as any bill payment details that could be used in spoofing your account information or identity. Please view the provider’s support documentation or contact their support with details on how to best secure your account.

Mobile Phone Providers

Securing mobile telecom providers is extremely important. These accounts can be used to perform Sim Swaps on your account. These attacks try to clone or create new SIM cards for your mobile phone number which can then be used to receive 2FA codes for other services. Some providers will allow you to set up alerts for any changes to your account, it is recommended to contact and explore the options that are relevant to you with your cell phone provider.

Information on SIM Swap Attacks (https://www.priv.gc.ca/en/blog/20200312/

• Rogers (Understanding multi-factor authentication - Rogers)

• Telus (My TELUS 2-factor authentication | TELUS Support)

• Bell (Multi-factor authentication for MyBell)

Social Media Accounts

• Facebook (Using an app for two-factor authentication on Facebook)

• Instagram (Two-factor authentication – Instagram)

• Twitter/X (How to use two-factor authentication (2FA) on X)

Personal FAQ's

Signing In

Before you log into both the online banking platform and mobile app, please be sure that you have verified your contact info with us. To connect to the new platforms your mobile phone number or email will need to be entered and they must match our records in order to verify your identity.

When you sign in for the first time, you will use your 19-digit debit card number. After creating a unique username and password in the new online banking platform, you will use those to sign in going forward.

You can enter your debit/membercard number in place of your username.

You can click the Forgot Username or Password? link located on the online banking or mobile banking app sign in page and follow the instructions. You must have a valid email address or mobile phone number on file to complete this action.

Or you can contact us at 1-877-226-7957.

1. Sign in to online banking

2. Hover over My Fusion

3. Under Settings click on Password

4. Under Password details enter your current password and the new password. When done click Continue

5. You will receive a notification to your email that you have updated your password

You must have a valid mobile phone number on file to complete this action.

You can click the Forgot Username or Password? link located on the online banking sign in page and follow the instructions to complete a password reset vis SMS (mobile device). You must have a valid mobile phone number on file to complete this action.

Please note that changing a password by receiving a verification code through email is not available.

If you do not have a mobile device, please contact us at 1-877-226-7957 to change your password.

Two-Factor Authentication

Two-Factor Authentication

Two-factor authentication is an added layer of security for our digital platform. It’s a numeric security code (up to 7 digits) that you will receive via text message to your mobile phone or to your email address when you perform certain activities.

The code is time sensitive and valid only for a limited amount of time. Here are some examples of when one-time passcodes are used:

- Register for online banking

- First time you sign in to online banking

- Add a new bill vendor

- Update contact information

- Change or reset your password (codes are sent to mobile phones (SMS) only, not email)

- Transfer funds to other members

- Add an Interac e-Transfer® recipient

Alerts

You can setup Account Alerts to individual accounts for notification of specific banking events. Different alerts can be setup on different accounts.

- Transaction Alerts such as deposit or withdrawal, or balance (daily, weekly or monthly) alert that lets you know what your balance is in a specific account.

- Insufficient Funds Alert when you have a scheduled transfer or bill payment

- Failed Transaction Alert is when a scheduled transfer or bill payment did not occur for whatever reason.

Security Alerts are set mostly by default to protect you when it comes to changes happening to your accounts. This will protect you in the case of someone trying to get into your accounts. This includes events such as:

- Password changes (if someone changes your password)

- New biometric access (if someone attempts to add another FaceID or fingerprint access to your account from a mobile device)

- Password attempt lock (if someone has tried to access your account and has failed to guess your password in three attempts)

- Successful login (optional)

Bill Payments

Bill payments made after 10:20 pm will be processed with the following day’s date. The payments will be processed by 10:20 pm the following day. You can view and/or delete your bill payments in your list of Scheduled Payments until the time payments are processed.

Please note that vendor settlement times vary. To ensure your bill payments are received before the due date, submit your bill payment at least three (3) business days prior to the due date.

Other FAQs

Our secure messaging service allows you to communicate with us from within the online banking system and is only available after you have signed in. You may include account numbers and any other information that may help us better assist you with your questions.

Please use the secure message feature within online banking instead of sending personal information through unsecure email channels or text messages.

In online banking, from My Fusion, select Messages or you can click the envelope icon located at the top right corner on your main online banking page.

On the Mobile App, you access Messages by tapping the envelope icon located at the top right corner on your main screen.

Note: Our standard response time is by next business day. If your query is urgent, please contact us.

Yes, you can download your account activity to the following software programs:

- CSV

- PDF (PDF is only program available with the mobile app)

- Microsoft Money (OFX)

- Quicken (QFX)

- Sage 50 (OFX)

- Xero (OFX)

Yes. There is a "Mobile Deposit" feature where you can deposit cheques remotely.

Note: US cheques cannot be deposited to US chequing accounts via Mobile Deposits.

Yes, by clicking on the ‘Filter’ (magnifying glass) icon at the top right of the View Transactions screen, you can select the date range using the calendar icon in the ‘From’ and ‘To’ sections.

You can also filter the types of transactions you can see by clicking the down arrow next to ‘Show’.

- If you’re using online banking click Accounts, under Accounts select View eStatements.

- Select the year and date of the statement you want to view

- On Business Online Banking, to view eStatements for Consolidated accounts, you will need to switch between membership profiles to retrieve eStatements.

To get started with digital banking, attend a local branch, contact eServices at 1-877-226-7957 or info@fusioncu.com.

If you are having any troubles with online banking, please contact eServices at 1-877-226-7957 or info@fusioncu.com.

2. Hover over My Fusion.

3. Under Settings click on Contact Details.

4. Under Phone and email verify or enter your desired phone number and email address. If you choose to update your information, an OTP will be sent to the NEW contact method to confirm the update BEFORE you can consent to the privacy agreement and click Continue.

5. On the following screen you will have to enter the OTP from the previous contact method.

6. You will receive a notification to your email that you have updated your password.

Business Banking FAQ's

Check your spam or junk folder. If the code it not there, resend the code. If that still does not work, call us at 1-877-226-7957.

Start by completing your initial sign in for each membership separately. Once you have completed the onboarding process for all of your memberships, you can then consolidate them as required. Once you have completed this step, you will be able to sign in once, and switch between any of your consolidated profiles as needed.

You can enter your debit/membercard number in place of your username.

You can click the Forgot Username or Password? link located on the online banking or mobile banking app sign in page and follow the instructions. You must have a valid email address or mobile phone number on file to complete this action.

Or you can contact us at 1-877-226-7957.

If you have your membership set up as requiring two-signer approval for transactions like bill payments and Interac e-Transfers®, you can approve the transactions within digital banking.

- Sign in to digital banking

- From the menu, click Business Services, then Review Pending Transactions

Search

Search

www.google.com

www.google.com